- Goldman Sachs, Barclays say jobs data boost case for rate hike

- Citigroup, Deutsche Bank see policy makers likely to wait

Treasuries traders who were looking to Friday’s U.S. jobs data to settle the Federal Reserve’s path on interest rates came away just as uncertain as before.

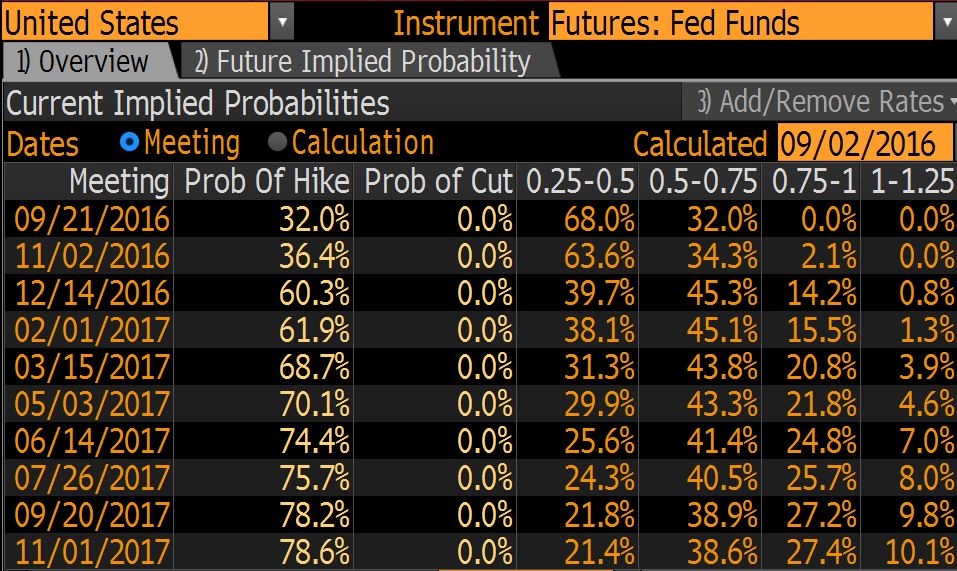

A lukewarm August payrolls report left Wall Street divided about whether policy makers will act when they meet Sept. 20-21. Strategists at Goldman Sachs Group Inc. and Barclays Plc said the report bolsters the case for a September hike, while Citigroup Inc. and Deutsche Bank AG said the data don’t support such a move. Futures traders showed little more conviction, assigning a 32 percent probability to an increase this month, barely lower than the 34 percent chance seen a day earlier.

The report added to a mixed bag of U.S. economic data this week that clouded the monetary-policy outlook after Fed Chair Janet Yellen said Aug. 26 that the case for higher rates had strengthened. The Federal Open Market Committee, which entered 2016 projecting four hikes, has instead stood pat and pared those forecasts twice as central banks abroad boosted stimulus to combat slowing economic growth.

"This is going to put the Fed in a really tricky position when they next meet," Mohamed El-Erian, chief economic adviser at Allianz SE, said in an interview on Bloomberg Television. “This is going to ultimately come down to one fundamental issue: how worried are Fed officials about the collateral damage and the unintended consequences of a protracted period of low interest rates?"

Jobs Data

Treasury two-year notes, the coupon securities most sensitive to Fed policy expectations, rose this week, with yields falling six basis points, or 0.06 percentage point, to 0.79 percent, according to Bloomberg Bond Trader data.

The U.S. added 151,000 positions in August, less than the 180,000 median forecast of economists surveyed by Bloomberg, Labor Department data showed Friday. A 275,000 gain in July was larger than previously estimated. The jobless rate and labor participation rate held steady, while wage gains moderated and hours worked were the lowest since 2014.

After the report, economists at Goldman Sachs led by Jan Hatzius boosted the probability of a Fed move this month to 55 percent from 40 percent. They wrote in a note that the labor-market gains were were "just enough" to support a September increase.

For a quick roundup of analyst reaction to the report, click here.

Strategists at Barclays concurred. The data “should maintain the confidence of most FOMC members in the outlook,” Michael Gapen and Rob Martin wrote in a note to clients. "We maintain our call of a September rate hike."

By contrast, Deutsche Bank sees the Fed inclined to wait. “We don’t think the data support a hike in September,” economist Aditya Bhave said in phone interview. "We’ve been in the December camp since the beginning of the year and we’re sticking with that view.”

Futures traders on Friday assigned about 60 percent probability to a rate increase by December, little changed from a day earlier. The calculation is based on the assumption that the effective fed funds rate will trade at the middle of the new FOMC target range after the increase.

Citigroup strategists wrote in note that the jobs data reduced the likelihood of a Fed hike in both September and December.

Speaking Friday, Richmond Fed President Jeffrey Lacker, who isn’t an FOMC voting member this year, called the data “perfectly close enough to expectations” and said he sees risks in delaying a hike for too long.

Whatever officials decide, they’ll need to get traders on the same page as the central bank, according to Priya Misra, head of global interest-rates strategy at TD Securities (USA) LLC, one of 23 primary dealers that trade with the Fed.

"I would not be surprised to see some Fedspeak addressing this report in coming days,” Misra wrote in response to questions asked by Bloomberg News. “If the Fed is inclined to hike, they need to move the market probability higher, and they have just next week to do this."

Click here to view original web page at www.bloomberg.com