No compatible source was found for this media.

OPEC’s decision to pump less is poised to deter some oil traders from hoarding crude at sea.

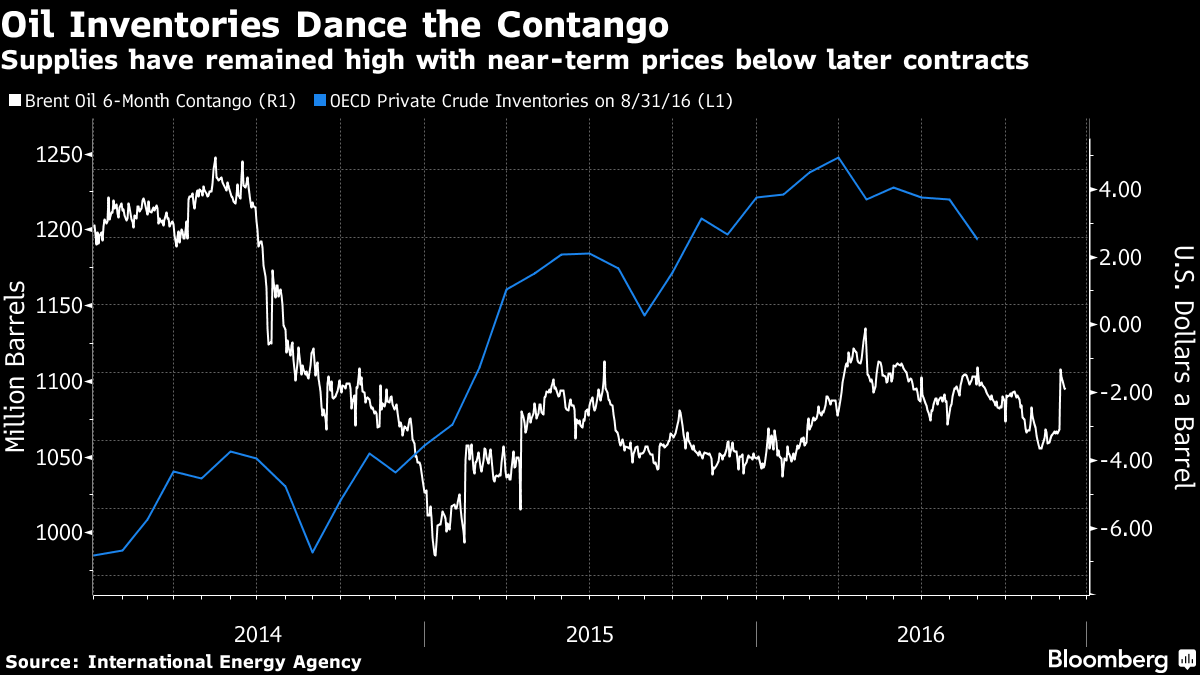

The group’s pledge to cut output and ease a global glut has weakened a market structure known as contango that benefited traders who stocked crude on ships to be sold at a potential profit in the future. The planned reductions have boosted the value of earlier-loading oil relative to cargoes for later, meaning returns from stored supplies aren’t going to be enough to offset the cost of chartering a tanker for months.

In one of the unintended consequences of the decision by the Organization of Petroleum Exporting Countries, millions of barrels that were in floating storage could potentially flood back into the market and limit the price jump from OPEC’s supply curbs. That adds to concerns that higher U.S. production next year may offset the group’s first output cuts in eight years, and hamper a sustained recovery in prices that are still more than 50 percent below 2014 levels.

“The contango trade is not going to be nearly as profitable next year as it was this year,” said Amrita Sen, chief oil analyst for industry consultant Energy Aspects Ltd. “If OPEC follows through with its cuts, you’re going to see global stocks of crude start to draw.”

The premium for later supplies of Brent, the benchmark for more than half of the world’s oil, shrunk to as little as $1.77 per barrel on Dec. 1, the day after OPEC agreed to curtail output by 1.2 million barrels per day. That’s not enough to make a profit after leasing a giant oil tanker for half a year at a cost equivalent of $3.15 to $3.38 per barrel, according to data from a shipbroker and charterer.

As recently as last month, that 6-month contango was at about $4.50 a barrel, which was a large enough gap to make it potentially viable for traders to profitably store crude for that long. The spread was at $2.62 a barrel as of 11:14 a.m. London time on Thursday.

Swiftly Narrowing

More than 100 million barrels of oil are being hoarded on vessels at sea, but with the contango “swiftly narrowing,” that figure will probably shrink in the future, according to Matt Smith, director of commodity research at ClipperData LLC, a firm that analyzes and tracks crude and fuel flows globally.

“One consequence of the OPEC decision was a sharp decline in contango for crude oil futures,” leading to the viability of storing oil on vessels to “reverse sharply,” JPMorgan Chase & Co. said in a note dated Dec. 5. “This meant that floating storage economics, which were modestly positive for several weeks, went decidedly negative.”

And it’s not just oil stored on supertankers that could seep into the market. The narrower contango probably means that crude held in onshore storage complexes such as South Africa’s Saldanha Bay “will likely start to get drawn down and compete with spot barrels,” Citigroup Inc. said in a research note dated Dec. 6.

A persistent contango since the oil market began crashing in mid-2014 has driven a record amount of oil into storage. Global industrial stockpiles in developed nations peaked at 1.23 billion barrels in March this year, with inventories still 17 percent above the five-year seasonal average in August, based on estimates by the International Energy Agency.

That inventory overhang is what OPEC says it’s targeting with its production cuts. The focus is now on which non-OPEC producers will join Russia in reducing output. OPEC is hoping they will cut another 300,000 barrels a day beyond the 300,000 barrels already promised by Russia.

“Much of the oil that has gone into landed and floated storage since the price slump began in mid-2014 has done so simply because it had nowhere else to go,” said Vandana Hari, principal at energy consultancy firm Vanda Insights. “Higher prompt prices could certainly spur oil to move out of storage -- possibly dulling the impact of OPEC’s restraint in the initial period once their agreement takes effect.”

Click here to view original web page at www.bloomberg.com